Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

Ad Disclosure

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

The Ethereum (ETH) price is pulling back after running into a wall of resistance at the $4,000 level, and was last down around 4% this Monday in the $3,800 area.

A bearish divergence on its 14-day Relative Strength Index (RSI) chart, which also recently just dropped back from overbought conditions, suggests continued near-term downside is a possibility.

A re-test of the 21DMA at $3,600, or even resistance turned support in the $3,500 area, are possibilities.

Elevated ETH futures funding rates and rising market profitability, per Glassnode data, further highlight the risk of a mid-bull market pullback.

But Ethereum bulls shouldn’t get overly pessimistic, as the medium-term outlook for Ethereum is as strong as it has been for years.

Altcoin Season Is Here

While much has been made of Ethereum’s “decline” relative to some of its rising rivals such as Solana and Sui, this narrative is overstated.

Ethereum remains the dominant DeFi chain, retaining a commanding share of trade value-locked smart contracts.

Per DeFi Llama, crypto assets worth over $76 billion are locked in smart contracts on the Ethereum blockchain, a 56% market share.

Meanwhile, Ethereum remains the only altcoin to have secured spot ETFs in the USA, making it the major gateway for institutional investors seeking to gain exposure to the altcoin market.

All of that means that Ethereum is set to be a major beneficiary of any future altcoin seasons.

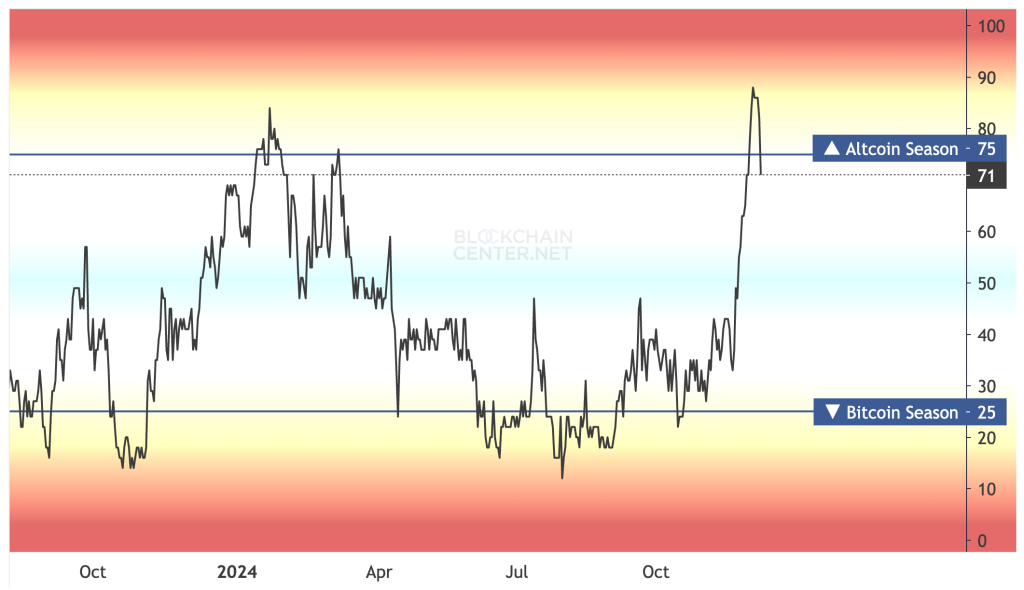

And altcoin season has arguably already returned. blockchaincenter.net‘s index recently flew into altcoin season territory. CMC’s altcoin season index is painting a similar picture.

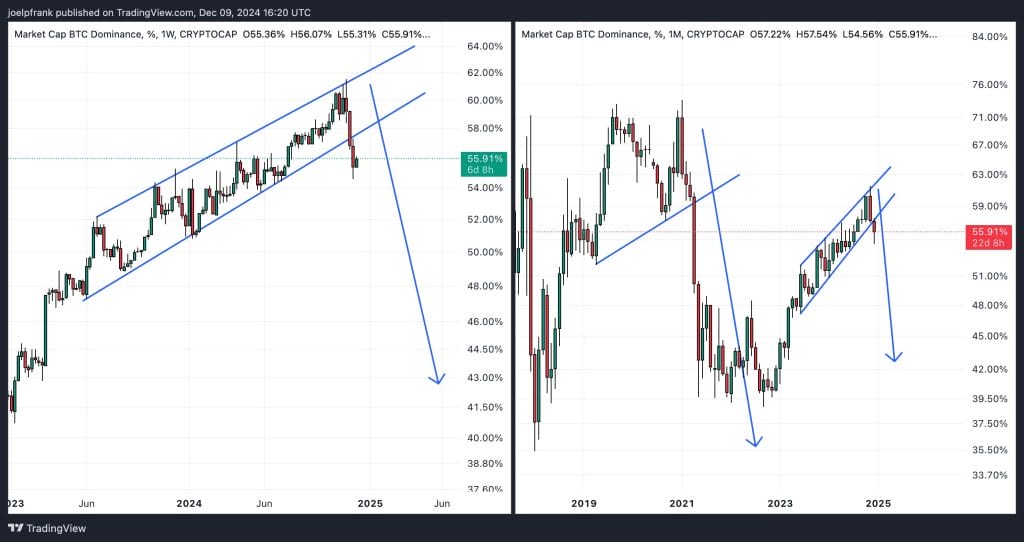

Bitcoin (BTC) dominance also just started to break down in a major way for the first time since early 2021.

If history does repeat, BTC.D could be about to crater from its current levels around 56% all the way to around 40%, as a result of altcoin outperformance, not as a result of poor Bitcoin performance.

Indeed, the medium-term outlook for the Bitcoin price remains strong. Just under 8 months on from its halving, BTC broke into a new phase of price discovery in November following the positive US Presidential and Congressional election results.

A meaningful breakout above $100,000 is yet to materialize, but historic Bitcoin price cycles suggest the top isn’t in yet, and a move to $150,000 and beyond is on the table for 2025.

Where Next for the Ethereum Price?

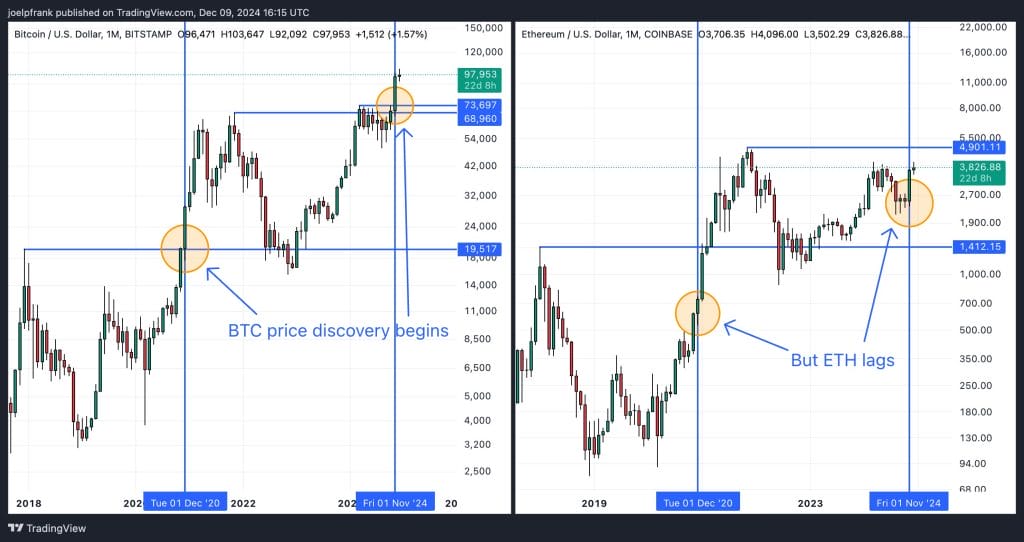

Bitcoin’s breakout to fresh record highs is a very important development for Ethereum, which tends to follow closely behind the world’s largest crypto by market cap.

In the 2020/2021 bull cycle, when Bitcoin broke out to fresh record highs in December 2020, Ethereum was still substantially below its record levels.

In 2020/2021, took ETH an additional month to even test its prior record highs. And then the actual Ethereum price discovery didn’t kick off until 2 months after Bitcoin price discovery began.

We are seeing the exact same setup play out in 2024. If history does repeat, we could see the Ethereum price retest its record highs but fail to break out this month decisively.

Real ETH upside price discovery (i.e. a move above $5,000) may need to wait for January 2025.

Around this time, there will be plenty of narratives about the positive shift in US crypto regulation as the Trump administration moves into the White House and the new Congressional session begins, meaning plenty of fodder to power a major rally.

Ethereum investors need to be patient and not get shaken out in the event of any short-term market dips.

Bitcoin’s price rally suggests further upside could be right around the corner for ETH and Ethereum price predictions are likely to remain bullish.