Last updated:

Why Trust Cryptonews

Why Trust Cryptonews

The Russian Central Bank has announced that it will start monitoring the blockchain technology-powered “digital assets markets” in real time.

According to Vedemosti, the bank wants to focus its attention on digital financial assets (DFA) offerings.

The bank thinks this move will “reduce the regulatory burden” on platform operators and “increase investor confidence.”

Russian Central Bank Wants All DFAs Operators to Fall in Line

Russian banks and other firms have thrown their weight behind the DFA sector in recent months, launching a wide range of blockchain-powered offerings.

Many of these are tied to real estate prices. But others are tied to other real-world assets, including precious metals.

The bank has asked information system operators at DFA platforms to “provide the bank with online access to information.”

The Central Bank will thus begin monitoring data related to transactions, token issuers, and DFA buyers.

Atomyze, the brainchild of the DFAs pioneer and metal mining giant Norilsk Nickel (Nornickel), says it has created a “tool” that lets the bank monitor its trading platform.

Spokespeople told the newspaper that other notable players are also planning to use the same tool or develop their own.

This group reportedly includes SPB Exchange, CFA Hub, Tokeon, Masterchain, and Lighthouse.

Bank Has Conducted ‘Successful Pilot with Nornikel’

Vedomosti quoted a Central Bank spokesperson as saying that platform providers are “interested in developing” ways to “interact” with the bank.

The bank has full control over the sector and is the only body in Russia that can issue DFA issuance permits.

Kristina Aleshina, Deputy Director of the Russian Central Bank’s Financial Market Infrastructure Department, said that the bank and Atomyze had completed a “successful pilot.”

Aleshina told attendees at a digital finance forum that Atomyze has developed a “data dashboard.”

“We currently receive supervisory reports 15 days after the reporting date. But [the tool] lets us see [the data] online every day. We wrote similar letters to other [platforms], asking them to consider doing likewise. Because it will benefit everyone: the platforms themselves, the Central Bank, and investors.”

Kristina Aleshina, Deputy Director of the Financial Market Infrastructure Department at the Russian Central Bank

Media analysts claimed the new system would “reduce risks for the market, especially if one of the operators ceases operations.”

However, they said that launching such a system would “require technological improvements and investments from DFA operators.”

The Rise of DFAs

Most popular DFAs in Russia currently function as blockchain-powered bonds. Banks like Alfa-Bank and VTB have issued scores of these offerings in recent weeks.

Alfa-Bank alone has released over a dozen DFAs so far this month, with trading volumes across the sector ballooning in the past 12 months.

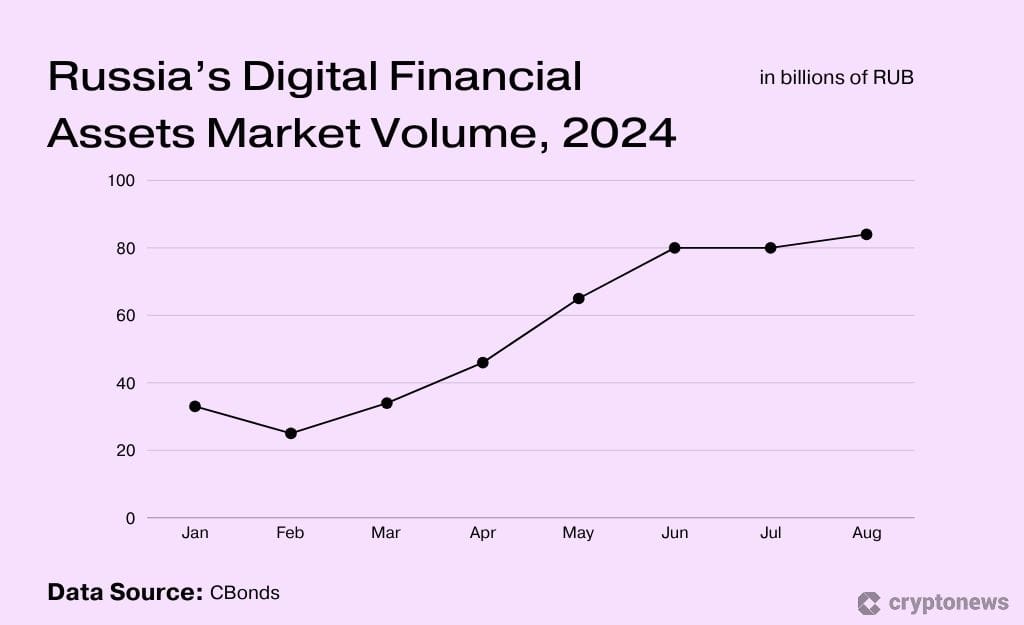

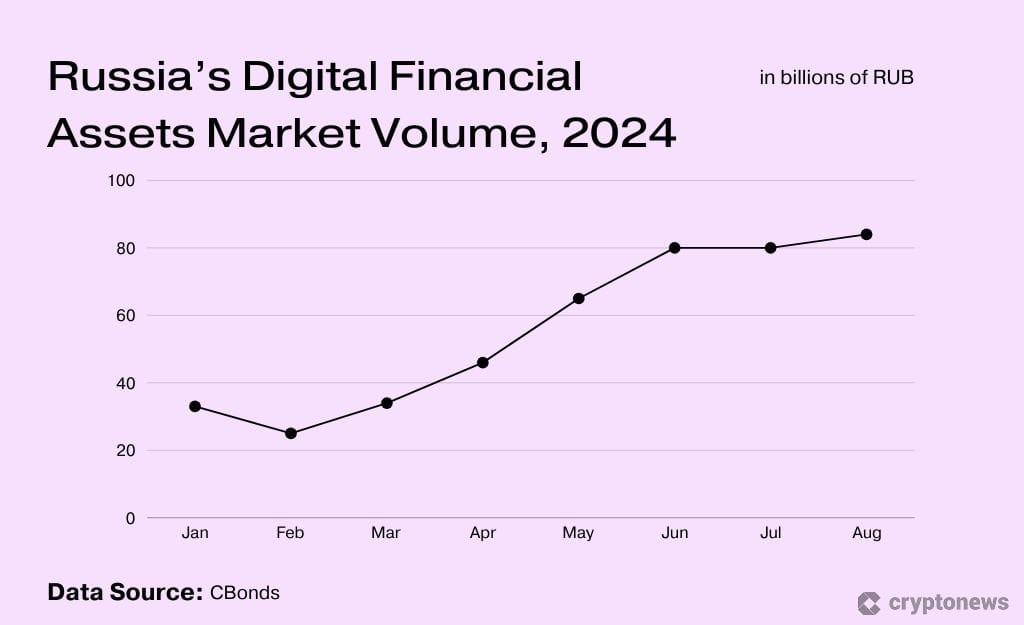

Volumes have risen from RUB 19.7 billion in August last year to RUB 115.8 billion last month, data from Cbonds indicates.

Moscow has recently passed a law that allows Russian firms to use domestic DFAs as a payment tool in cross-border trade.

However, business leaders say that Moscow should also allow them to use cryptoassets like Bitcoin (BTC) to pay for goods and services overseas.